Whither the US Dollar? Inflation remains a threat to SaddleBrooke

VIA SBINSIDER and numerous sources| May 28th, 2023

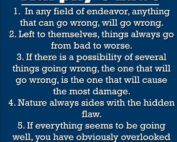

Almost all retirees always have a concern: No matter how much money they have in the bank, we worry that we will burn through our savings before our allotted time on earth is up. This is not irrational. We all know of fellow residents or retired friends and relatives that have had to downsize or move in with their adult children for financial reasons. Compounding the worry are the actions of the Federal Government in concert with the Federal Reserve.

Inflation, the never-ending destroyer of wealth, has lessened of late in reaction to the Federal Reserve raising interest rates and cooling the real estate sector and the IPO funny money markets. Congress too, plays a role in that it is in control of fiscal policy-how much the Federal Government will spend annually-which had increased tremendously under President Biden.

Inflation is a deliberate policy

The Federal Reserve meets regularly as a Board of Governors and sets monetary policy-whether to increase the money supply, thereby trying to boost the economy or raise rates to slow it down. The key thing is setting the annual growth of the supply of money and it is usually 2-4% which means to retirees that their money in savings is going to be worth less by that same amount every year. The deliberate inflation policy is designed to allow the economy to grow organically by providing the funds needed to grow business activity. But sometimes, like now it gets out of control.

COLA to the Rescue?

The aftermath of the inflation ravaged economy of the late 70’s spurred Congress to try and protect income and savings from the very inflation Congress and the Federal Reserve had created. COLA, for Coast of Living Adjustment, is meant to maintain the purchasing power of Social Security and other retirement plans funded by the taxpayers. It is an extremely complex process and experts have argued for years as to what cost components should be included in the index that sets the COLA. In 2022 the adjustment was 5.9% and in 2023 8.7%.

Do COLAS work ?

Depends on you and your financial situation. Most SaddleBrooke residents are NOT solely dependent on Social Security. But with the overall stock market down about 10% since December of 2022 and inflation in the sectors most residents purchase, food (up 11%), gas and electricity (15%) most of us are treading water.

On the other hand, citing Social Security Administration data, CNBC reported this week that about 12 percent of men and 15 percent of women “rely on their monthly Social Security check for nearly all of their income,” with “nearly all” defined as 90 percent or more.

Check this table and you can get a handle on where we have been vis-à-vis inflation since 1929 (we al remember that year):

| YEAR | INFLATION RATE YOY4 | FED FUNDS RATE*5 | BUSINESS CYCLE (GDP GROWTH)67 | EVENTS AFFECTING INFLATION8 |

|---|---|---|---|---|

| 1929 | 0.6% | NA | August peak | Market crash |

| 1930 | -6.4% | NA | Contraction (-8.5%) | Smoot-Hawley |

| 1931 | -9.3% | NA | Contraction (-6.4%) | Dust Bowl |

| 1932 | -10.3% | NA | Contraction (-12.9%) | Hoover tax hikes |

| 1933 | 0.8% | NA | Contraction ended in March (-1.2%) | FDR’s New Deal |

| 1934 | 1.5% | NA | Expansion (10.8%) | U.S. debt rose |

| 1935 | 3.0% | NA | Expansion (8.9%) | Social Security |

| 1936 | 1.4% | NA | Expansion (12.9%) | FDR tax hikes |

| 1937 | 2.9% | NA | Expansion peaked in May (5.1%) | Depression resumes |

| 1938 | -2.8% | NA | Contraction ended in June (-3.3%) | Depression ended |

| 1939 | 0.0% | NA | Expansion (8.0% | Dust Bowl ended |

| 1940 | 0.7% | NA | Expansion (8.8%) | Defense increased |

| 1941 | 9.9% | NA | Expansion (17.7%) | Pearl Harbor |

| 1942 | 9.0% | NA | Expansion (18.9%) | Defense spending |

| 1943 | 3.0% | NA | Expansion (17.0%) | Defense spending |

| 1944 | 2.3% | NA | Expansion (8.0%) | Bretton Woods |

| 1945 | 2.2% | NA | Feb. peak, Oct. trough (-1.0%) | Truman ended WWII |

| 1946 | 18.1% | NA | Expansion (-11.6%) | Budget cuts |

| 1947 | 8.8% | NA | Expansion (-1.1%) | Cold War spending |

| 1948 | 3.0% | NA | Nov. peak (4.1%) | |

| 1949 | -2.1% | NA | Oct trough (-0.6%) | Fair Deal, NATO |

| 1950 | 5.9% | NA | Expansion (8.7%) | Korean War |

| 1951 | 6.0% | NA | Expansion (8.0%) | |

| 1952 | 0.8% | NA | Expansion (4.1%) | |

| 1953 | 0.7% | NA | July peak (4.7%) | Eisenhower ended Korean War |

| 1954 | -0.7% | 1.25% | May trough (-0.6%) | Dow returned to 1929 high |

| 1955 | 0.4% | 2.50% | Expansion (7.1%) | |

| 1956 | 3.0% | 3.00% | Expansion (2.1%) | |

| 1957 | 2.9% | 3.00% | Aug. peak (2.1%) | Recession |

| 1958 | 1.8% | 2.50% | April trough (-0.7%) | Recession ended |

| 1959 | 1.7% | 4.00% | Expansion (6.9%) | Fed raised rates |

| 1960 | 1.4% | 2.00% | April peak (2.6%) | Recession |

| 1961 | 0.7% | 2.25% | Feb. trough (2.6%) | JFK’s deficit spending ended recession |

| 1962 | 1.3% | 3.00% | Expansion (6.1%) | |

| 1963 | 1.6% | 3.5% | Expansion (4.4%) | |

| 1964 | 1.0% | 3.75% | Expansion (5.8%) | LBJ Medicare, Medicaid |

| 1965 | 1.9% | 4.25% | Expansion (6.5%) | |

| 1966 | 3.5% | 5.50% | Expansion (6.6%) | Vietnam War |

| 1967 | 3.0% | 4.50% | Expansion (2.7%) | |

| 1968 | 4.7% | 6.00% | Expansion (4.9%) | Moon landing |

| 1969 | 6.2% | 9.00% | Dec. peak (3.1%) | Nixon took office |

| 1970 | 5.6% | 5.00% | Nov. trough (0.2%) | Recession |

| 1971 | 3.3% | 5.00% | Expansion (3.3%) | Wage-price controls |

| 1972 | 3.4% | 5.75% | Expansion (5.3%) | Stagflation |

| 1973 | 8.7% | 9.00% | Nov. peak (5.6%) | End of gold standard |

| 1974 | 12.3% | 8.00% | Contraction (-0.5%) | Watergate |

| 1975 | 6.9% | 4.75% | March trough (-0.2%) | Stop-gap monetary policy confused businesses and kept prices high |

| 1976 | 4.9% | 4.75% | Expansion (5.4%) | |

| 1977 | 6.7% | 6.50% | Expansion (4.6%) | |

| 1978 | 9.0% | 10.00% | Expansion (5.5%) | |

| 1979 | 13.3% | 12.00% | Expansion (3.2%) | |

| 1980 | 12.5% | 18.00% | Jan. peak (-0.3%) | Recession |

| 1981 | 8.9% | 12.00% | July trough (2.5%) | Reagan tax cut |

| 1982 | 3.8% | 8.50% | November (-1.8%) | Recession ended |

| 1983 | 3.8% | 9.25% | Expansion (4.6%) | Military spending |

| 1984 | 3.9% | 8.25% | Expansion (7.2%) | |

| 1985 | 3.8% | 7.75% | Expansion (4.2%) | |

| 1986 | 1.1% | 6.00% | Expansion (3.5%) | Tax cut |

| 1987 | 4.4% | 6.75% | Expansion (3.5%) | Black Monday crash |

| 1988 | 4.4% | 9.75% | Expansion (4.2%) | Fed raised rates |

| 1989 | 4.6% | 8.25% | Expansion (3.7%) | S&L Crisis |

| 1990 | 6.1% | 7.00% | July peak (1.9%) | Recession |

| 1991 | 3.1% | 4.00% | Mar trough (-0.1%) | Fed lowered rates |

| 1992 | 2.9% | 3.00% | Expansion (3.5%) | NAFTA drafted |

| 1993 | 2.7% | 3.00% | Expansion (2.8%) | Balanced Budget Act |

| 1994 | 2.7% | 5.50% | Expansion (4.0%) | |

| 1995 | 2.5% | 5.50% | Expansion (2.7%) | |

| 1996 | 3.3% | 5.25% | Expansion (3.8%) | Welfare reform |

| 1997 | 1.7% | 5.50% | Expansion (4.4%) | Fed raised rates |

| 1998 | 1.6% | 4.75% | Expansion (4.5%) | LTCM crisis |

| 1999 | 2.7% | 5.50% | Expansion (4.8%) | Glass-Steagall repealed |

| 2000 | 3.4% | 6.50% | Expansion (4.1%) | Tech bubble burst |

| 2001 | 1.6% | 1.75% | March peak, Nov. trough (1.0%) | Bush tax cut, 9/11 attacks |

| 2002 | 2.4% | 1.25% | Expansion (1.7%) | War on Terror |

| 2003 | 1.9% | 1.00% | Expansion (2.9%) | JGTRRA |

| 2004 | 3.3% | 2.25% | Expansion (3.8%) | |

| 2005 | 3.4% | 4.25% | Expansion (3.5%) | Katrina, Bankruptcy Act |

| 2006 | 2.5% | 5.25% | Expansion (2.9%) | |

| 2007 | 4.1% | 4.25% | Dec peak (1.9%) | Bank crisis |

| 2008 | 0.1% | 0.25% | Contraction (-0.1%) | Financial crisis |

| 2009 | 2.7% | 0.25% | June trough (-2.5%) | ARRA |

| 2010 | 1.5% | 0.25% | Expansion (2.6%) | ACA, Dodd-Frank Act |

| 2011 | 3.0% | 0.25% | Expansion (1.6%) | Debt ceiling crisis |

| 2012 | 1.7% | 0.25% | Expansion (2.2%) | |

| 2013 | 1.5% | 0.25% | Expansion (1.8%) | Government shutdown. Sequestration |

| 2014 | 0.8% | 0.25% | Expansion (2.5%) | QE ends |

| 2015 | 0.7% | 0.50% | Expansion (3.1%) | Deflation in oil and gas prices |

| 2016 | 2.1% | 0.75% | Expansion (1.7%) | |

| 2017 | 2.1% | 1.50% | Expansion (2.3%) | |

| 2018 | 1.9% | 2.50% | Expansion (3.0%) | |

| 2019 | 2.3% | 1.75% | Expansion (2.2%) | |

| 2020 | 1.4% | 0.25% | Contraction (-3.4%) | COVID-19 |

| 2021 | 7.0% | 0.25% | Expansion (5.9%) | COVID-19 |

| 2022 | 6.5% | 4.25% | Contraction (-1.6%) | |

| 2023 | 2.7% (est.) | 2.8% (est.) | Expansion (2.2%) | March 2022 projection |

| 2024 | 2.3% (est.) | 2.8% (est.) | Expansion (2.0%) | March 2022 projection |

The real value of our 401K.s continue to drop. The way it is going, even dog and cat food will be too expensive for our SaddleBrooke generation. Thank you big spenders in Washington!