Stagflation Part Two Dr. Doug Cardell

VIA SBINSIDER ECONOMIC GURU DOUG CARDELL, Ph.D. | June 8th, 2024

Stagflation – Part 2

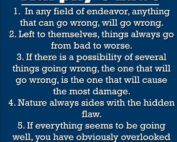

In part 1, we found that the administration, along with the Congress, are the primary culprits in the increasing possibility of stagflation. The reckless spending of borrowed money has always had this sort of effect. However, the Fed bears its share of the blame for its undeserved faith in its economic models. It seems that no matter how often the models are wrong, the Fed continues to act as though they were reliable. My analysis of the Fed’s projections of the Real Personal Consumption Expenditures was the bulk of my doctoral dissertation. I found that its projections were correct five months out of 119 tested. I discovered its estimate was within .5%—the functional limit—49 times and inaccurate to the extent that it was useless 76 times. Eight percent of the time, the Fed missed the amount of the move and predicted the move in the wrong direction, up instead of down or the reverse. The Fed was ‘right’ with sufficiently helpful accuracy only 43% of the time. There is a truism that says the definition of insanity is doing the same thing over and over and expecting different results.

Below is a graph of the difference between the Fed’s quarterly projections of the Consumer Price PI) and the Gross Domestic Product (GDP) year-over-year.

Useful projections must be within .5%. As you can see in the graph, the Fed’s projections were within this limit three times for both the CPI and the GDP in the past thirteen quarters. They were correct less than one-fourth of the time. Looking at the CPI for June 2021, you can see that their projection missed the mark by almost seven percent. The Fed’s average over this period was 2.98% for the CPI, six times beyond the limit of usefulness. It was 2.06% in the case of the GDP, four times the limit. In June 2020, well into the pandemic, when the Fed should have been aware of its effects, the Fed projected that the CPI in June 2021 would be 2.37%, and the actual CPI was 9.1%.

While it’s fair to say that the Fed couldn’t have predicted the Covid pandemic, that’s an inherent part of the problem. One of the factors that makes economic predictions problematic are black swans—rare events that do occur. However, the Fed made most of the projections in the graph above after the pandemic had begun, so that shouldn’t have been a significant factor. Of course, the real question is whether we are headed for a stagflation scenario right now. The simple answer is that it is just too early to tell. All the key indicators are certainly moving in that direction. As mentioned earlier, the Fed is hamstrung in its ability to prevent the economy from slipping further into a worse situation. Growth will likely continue to slow, inflation may creep up a bit more, and layoffs delayed from the pandemic will likely increase the unemployment rate. The probabilities of at least mild stagflation are better than 50-50, and more severe stagflation is possible.

The only long-term way to ensure economic stability is to stop borrowing money and spend less.

Having a fixed budget limit would solve the problem permanently. A reasonable and responsible limit to federal spending at ten percent of GDP would solve most of our problems. If implemented today, that would mean setting the spending limit at ten percent of the 2023 GDP or 2.736 trillion dollars instead of the projected 6.5 trillion. I would add an exception for an additional five percent of GDP or 1.368 trillion expressly to pay down the debt from the current 134% of GDP until it reaches twenty-five percent of GDP. At this rate, it would take about 25 years to return the national debt to a healthy level.

You know better than to spend 33% more annually than your income, and so should your representatives.