Stagflation Ahead? Dr. Doug Cardell Predicts

VIA DOUG CARDEL, ORACLE OF ORACLE | May 12th, 2024

Stagflation – Part 1

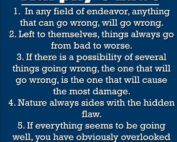

What Is Stagflation? Stagflation, a term that combines stagnation—low economic growth— and inflation, is not just a harmful economic condition but a potentially catastrophic one. It represents

a devastating combination of limited economic growth, high inflation, and high unemployment. While a severe supply-side shock, such as the early seventies OPEC oil embargo, can trigger it,

the cause is more often unwise economic policies, like high government spending or low interest rates. Stagflation frequently leads to a wage-price spiral when caused by poorly conceived

monetary policy. These complex interactions present the Federal Reserve (the Fed) with a particularly vexing problem, as attempting to solve one factor may exacerbate the others.

While the most often cited example is the Carter Presidency, it began much earlier. The initial cause was the increased borrowing during the Johnson administration to fund the Vietnam War and the war on poverty. It continued off and on through the Nixon, Ford, and Carter administrations. I was in Washington during the stagflation in early 1971, hired to aide a recently elected Member of Congress who was sworn in that January. I started in mid-February. On my first day, I was walking through a capitol corridor and happened to fall in step next to someone who looked familiar. I was walking and reading a policy brief when I saw a group of reporters with cameras and microphones blocking the way.

I kept walking and slowed along with the man next to me. A reporter extended a microphone toward the man next to me after saying, “Are you going to ‘jawbone’ me, Mr. Secretary? As it happened, the man next to me was John Connally, the newly confirmed Secretary of the Treasury. I just stood there, trying to look like I knew what was going on as the Secretary had a brief, informal press conference. Needless to say, my friends and family were astonished that I was on the national news on my first day. The term, jawbone, was Connally’s Texas speak for his plan to avoid wage and price controls by persuading companies and unions to voluntarily hold off wage and price increases. The plan didn’t work as well as he’d hoped, and the administration ultimately instituted wage and price controls. Stagflation often brings with it harsh measures that are employed in an attempt to control it.

Let’s examine the current economic landscape.

The latest GDP figures reveal a first-quarter 2024 growth of 1.6%, the lowest in two years and one-third below the projections. The inflation rate is 3.5% and rising faster than expected. The unemployment rate is 3.9% and has slowly increased for the past 20 months. These figures indicate more than a potential risk of stagflation, a scenario that could have significant economic implications and should not be taken lightly.

The Hanke Misery Index, which measures the effect of the economic picture on real people, is now at 12.5 and rising compared to a nominal 7.

Still, the result was two wrongs, making things even worse.

Ha ha, the FED in its last presser on interest rates by Chairman J. Powell in response to this very question stated he sees no stag nor flation. Is Chair Powell doing a Pinocchio?

Nvidia and Apple Rival Gold as Inflation HedgeWe asked: Which haven protects best against inflation?

Source: Bloomberg MLIV Pulse survey May 6-10. Respondents who chose `other’ wrote in: bonds, cash,

https://www.bloomberg.com/news/articles/2024-05-13/nvidia-rivals-gold-as-shield-against-inflation