Should You Pay with Cash or Credit?

SBINSIDER ECONOMICS ORACLE DR. DOUG CARDELL| 2-25-2024

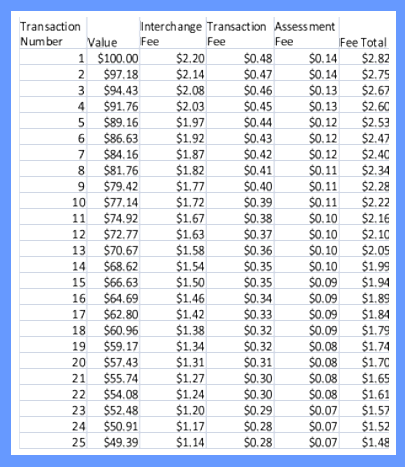

Let’s say you drop by your local computer shop to get a tune-up for your laptop. The bill is $100. Does it make a difference if you pay with cash or a card? Yes, a big difference. Let’s do the math. The computer shop owner takes his family to dinner. If you paid by cash, he takes your hundred-dollar bill and pays the restaurant. If you paid by credit card, he only got to keep $97.18; the rest went to credit card fees. $2.20 paid the interchange fee, which went to the bank issuing the card, 48 cents paid the transaction fee, which went to the processing company, and fourteen cents paid the assessment fee, which went to the credit card network. Now, the restaurant owner uses what he received to pay his daily bread supplier. If you paid cash and he does as well, he buys $100 worth of bread with your $100 bill.

If you and he paid by credit card, he only has $94.43 to buy bread with. As you can see in the table below, this process goes on until after 25 transactions, the original $100 is cut in half.

This process continues, and you can see in the graph below that after 103 transactions, the $100 has all gone to banks and credit card companies.

Declining Value of Card Transactions:

Value after X Transactions

However, if all the transactions had been cash, the $100 bill would still be there. With credit card transactions, the banks and credit card companies have the hundred dollars, and the consumers have nothing. I used cash to make it clearer, but a check would work just as well. The hundred dollars would move, intact, from one bank account to another. Debit cards have charges much like credit cards, but they are not nearly as high as credit card fees. With debit cards, it might take a thousand transactions to disappear, but it would still disappear.

If more of us used cash or checks for more transactions, particularly with local merchants, we’d all get to keep more of our money. If enough of us did it, it would result in lower prices for those using cash or checks. It’s safer, too. No one is going to skim or scam your credit card information if you’re using cash. Next time you go to the store, try taking four or five hundred dollars with you. I think you’ll like the feeling of buying your groceries with hundred dollar bills instead of a card. Give it a try.

I tried that – taking several $100 bills with me to the store – and the store said they refuse to take $100 bills. On the way out to the parking lot I was robbed. Had I used my credit card, the store would have taken it and I would have receive a $2 rebate (my Capital One and Wells Fargo CCs both rebate 2%!) per $100. It sounds selfish, but I am more concerned about my money than I am about the restaurant and the bakery. Credit cards also offer more convenience and protection against fraud and theft than paying with a check or debit card. Try paying for your gas next time with a check.