Protecting your Portfolio in 2024 with Bill Bengen

VIA SBINSIDER| January 6th, 2024

As we welcome a new year, most SaddleBrookers have money invested in various vehicles to protect their principal and glean some income to continue our “extravagant” lifestyles. Golf and Desert View Shows aren’t free, after all.

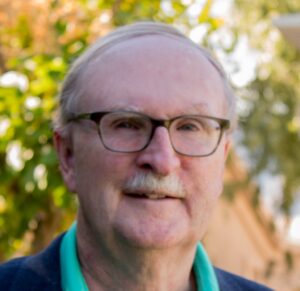

We are fortunate the William Bengen is a resident investment expert and is generous with his insights on looking ahead to 2024. Bill is truly famous in the investing world for the 4% formula, which roughly translates into a 4% drawdown from your retirement holdings annually. He is quoted in the Wall Street Journal, but mainly is a guru among his fellow Certified Financial Planners and their publications and podcasts. Bill sold his business in 2013 and moved to SaddleBrooke in 2019. He and Barbara Barr were wed in 2023.

SBINSIDER interviewed Bill in December for his current investment thinking, but before those details, it is interesting to note that Bill attended MIT back in the days when Aerospace Engineering was a hot degree. But, by the time he was ready go to the moon so to speak, NASA was cutting back and the demand for people with his expertise waned. He then reluctantly entered the family business and with his brother ran it successfully for many years until they went to his father and said the times had changed and they needed to sell the business while it was still highly valuable-which they did. Taking his windfall, Bill moved to California and became one of the 1st financial planners who worked on a fee-based system. Bill notes that many of his colleagues were more than a bit skeptical that he could make it work as the model had always been commission driven.

SBINSIDER Q. Bill what got you started on the journey to the 4% concept?

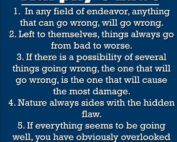

Bengen: When I went into the financial advising business in 1990, I was surprised to learn that no institution or financial scholar had ever done a study of how to withdraw your savings in a prudent way after retiring. As a natural numbers person, I went back to the data beginning in 1926, published by private sources about returns in various asset classes. My conclusion was that depending on externalities like inflation, war, government meddling or Black Swans, 4% or slightly more was a safe number even in a worst-case scenario.

Editors note: (That worst-case happened in 1968. Individuals who retired late in that year suffered through multiple major bear markets early in retirement, which devastated their stock holdings. In addition, double-digit inflation forced them to dramatically increase their withdrawals, which further devastated their investment portfolios.)

Q. Does your method consider asset allocation?

Bengen: Yes. The traditional balance has been 60% bonds and 40% stocks for older investors and my research supports that as a near=optimum allocation for retirees with a 30-year life expectancy. Older retirees should probably be a bit more conservative. But, each client has different goals and that is always a factor in what mix of stocks and bonds you should hold.

Q. How often do you advise clients to re-balance their portfolio?

Bengen: For most investors, once a year is likely enough, although some folks want to take a close look every quarter. Of course, the more often you make adjustments the costs to do so have to be factored in. Letting the money ride turns out statistically to yield a higher long term return, but very few investors can be that disciplined.

Q. With the caveat that you are not offering any specific advice, what would you withdraw from your portfolio this upcoming year.

Bengen: Historically, stocks are currently overvalued and a correction is due. However, it is an election year and the politics dictate that a robust economy helps all incumbents in both parties. So, I would withdraw 4.7% this year, which is equivalent to the updated rate for the 1968 “worst-case” scenario. That’s for an individual with a 30-year life expectancy. Those with a shorter life expectancy can take a bit more, and those with a longer life expectancy should probably take a bit less.

Q. Ok. As a retired CFP, do you paid for any investment advisor service?

Bengen: I do. I pay for information from Investech.com. Their motto matches mine which is “safety-first” profits.

SBINSIDER wishes to thank Bill Bengen for sharing his thoughts on investing in 2024.

Is there an investment club in SB where these things are discussed?