How Does Inflation Affect the Stock Market?

VIA SBINSIDER THE ORACLE OF ORACLE DOUG CARDELL Ph.D. |April 13th, 2024

How Does Inflation Affect the Stock Market?

There are several factors at play. First, inflation creates market uncertainty, which has a negative effect on the market. Second, inflation tends to make investors somewhat less risk-tolerant, raising the risk premium and depressing prices. Third, it may be that many investors misunderstand how inflation affects nominal dividend growth and continue to count on historical rates without considering the changes caused by inflation.

While all these issues have an effect, by far the most significant impact is the result of the Federal Reserve’s attempts to reduce inflation by raising interest rates. The data suggests that long-term investors holding well-diversified portfolios consisting primarily of value stocks—those with high intrinsic value—may not fare too badly if they hold their investments until long after inflation has returned to ‘normal’, less than two percent. Those investing over shorter terms, in limited portfolios, or in primarily growth stocks—those whose value relies on potential rather than current asset value—are likely to fare much worse.

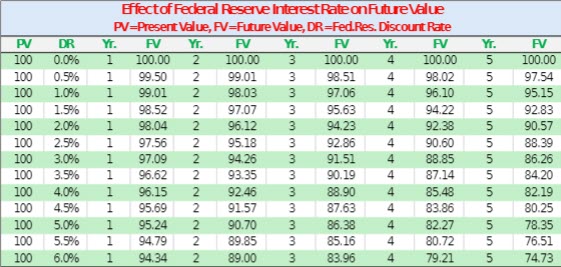

Higher interest rates reduce the future value of any asset that cannot increase in value faster than the inflation penalty. This loss is governed by the present value formula, where PV equals the present value, FV equals the future value, i equals the Fed’s discount rate, and n equals the number of compounding periods in years.

PV = FV (1 + i) n , but when interest rates decrease value the formula reverses so,

We can create a table of values from one to five years from this formula and see the results:

As you can see, raising the discount rate lowers the future value of an asset. It is not intuitively obvious why higher interest rates lower asset values.

There is a balance between the value of money and the value of stuff. Inflation increases the value—price—of stuff while decreasing the value of money. The Fed reverses the balance in its attempt to reverse inflation. It increases the value of money and decreases the value of stuff. Value stocks in companies with large asset pools see the value of those assets increase in times of inflation and then decrease in times of high interest. In the long run, the balance is restored, and asset value returns to actual value unmanipulated by the economy. Growth stocks often do not have a large asset pool and, therefore, cannot wait out market distortions that may last several years.

I love the analysis