Federal Debt Growth in 25 years

VIA SBINSIDER | May 2023

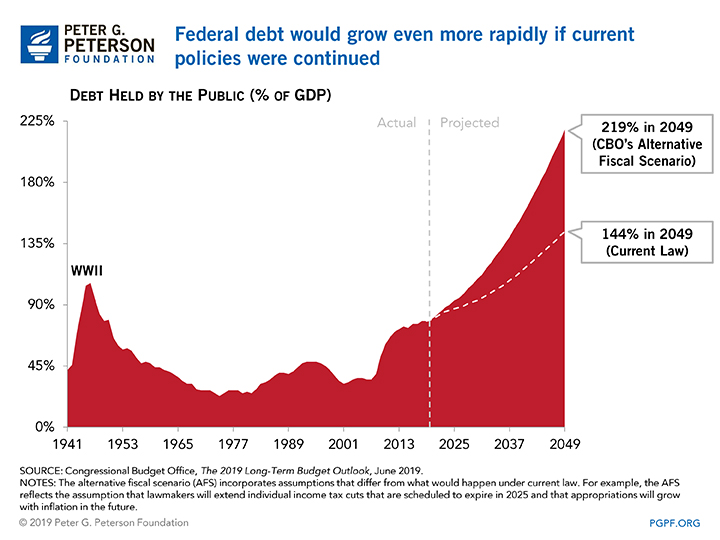

With the national debt limit debate raging in DC, the past 25 years have seen the unrestrained growth on borrowing and spending basically unabated. At the end of the Clinton Administration, the total national debt was around $5 trillion dollars. This came about as a result of various budget restraints such pay-go that only increased new spending as the GDP of the country grew.

Baby-boomers begin to retire

Both Republicans and Democrats agreed the projected spending for Social Security, Medicare, Medicaid and other fixed costs in the Federal budget were set to rise steadily in the 2000’s and they were correct. Baby-boomers began to retire and due to their over-representation as a percentage of the population as shown in the following figure the costs did indeed rise.

When George W. Bush took office he ran on income tax cuts and got them in his first budget. They were modest and did not dramatically alter the amount of borrowing needed. Then, the attack on 9-11 happened and all restraints were let loose. Bush decided he was a war President and country went along so every month the Congress approved monthly supplemental Defense appropriations for first Afghanistan and then Iraq wars. By the time Bush left office the national debt was doubled-to $10 trillion.

When Obama took office (2009) the economy was in a serious recession and wars were still ongoing. By the end of his 8 years in office the debt had doubled again to approximately $20 trillion. He also create a new level of fixed spending by dramatically expanding Medicaid via Obamacare.

In 2016, Trump ran on tax cuts and Congress delivered. Then, COVID hit and with the economy in free fall in March of 2020, Congress went on another spending spree. By the end of Trump’s term in 2020, the debt hit about $27 trillion.

Why no Inflation?

For years, the debt hawks had predicted high inflation due to borrowing and Federal Reserve low interest rates. But, when it failed to appear under Obama and Trump, the “new monetary theory” was that deficit spending was no longer a threat-until-until in April of 2021 these new theorists were smacked upside the head with a 4.2 rate followed by monthly increases hitting 7% by November. For all of 2022 the monthly rate stayed above 7% hitting 9.1% in June. At the time, Biden told the public that inflation was “temporary”. Not quite.

The Biden administration trumps Trump

Inflation is destroys wealth. (Except for residential property owners and other hard assets like gold) At some point, the Federal Reserve has to increase short term interest rates to try to end slow economic growth. And late last year the rates started to climb, affecting the stock market and residential real estate. As to workers hit the hardest by inflation are those at the media household income or below.

But it’s the other expensive legislation Biden has signed that pushed him past Trump. The much-vaunted Infrastructure Investment and Jobs Act spent another $765 billion, though the infrastructure expenditures will occur over the course of the next five years. The “comedian” activist Jon Stewart-promoted Promise to Address Comprehensive Toxics (PACT) Act contributed another $278 billion, while the recently passed CHIPS Act “chipped” in $255 billion more. And though congressional Democrats failed to pass Biden’s Build Back Better legislation earlier this year, its eventual successor, the Inflation Reduction Act, is still estimated by the CBO to add another $51 billion to the federal ledger.

Choices?

The Congress, if it decides to curb larger deficits, have two options, neither easy-cut spending and\or raise taxes. Borrowing more simply kicks the hard choices down the road and would signal to the financial markets that inflation will be a longer term threat. Will Americans put up with continued inflation that erodes their buying power?

excellent history. Question- what do we do? Discretionary spending is small potatoes in the budget. Defense? A none starter given ouur needs vs Russia and China and the rational decision to fund Ukraine? Medicare, Social Security, Medicaid as sacred as defense. So basically, that makes tax increases on corporations and the wealthy the only viable policy. Just rescinding the Trump tax cuts is a big step in deficit reduction. Caps on future spending would be helpful over time.

Raising taxes on “corporations” is a popular idea but the facts are only people pay taxes. All corporate taxes are passed on as overhead costs to the ultimate consumer. So, government rises taxes on gasoline producers, they in turn raise their prices to the wholesalers and then the retailers increase per gallon cost. It’s a shell game that the Left has bought into for years due to zero understanding of how business really operates.

If we care about our children and grandchildren this needs to be fixed!

In 2023, babies on the day they are born owe a $93,000 share of our national debt of which China is the largest debt holder.Enacting the current debt ceiling would be a small good first step.

Maybe it is time to examine “non-discretionary” spending and put everything on the table. All of our sacred cow socialist programs will be nothing if our government and economy fail.