Crypto-gets Bankman-Fried, Democrats get millions

VIA SBINSIDER COMMENTARY | November 5th, 2023

Sam Bankman-Fried, 31 years, old joins a long list of convicted Wall Street confidence men who used their extraordinary brainpower and total lack of ethics or moral sensibility to steal from investors.

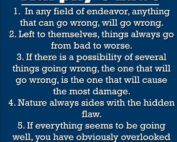

But they also have in common a type of investor who is desperate to get into the “next big thing” and throw aside common sense and are charmed by the oversized personality of the fraudster, like Robert Preston’s “Harold Hill” in the Music Man. These investors let their emotions and their egos stick with the con men\women long after the evidence of their fraud is exposed. Right until the end, former Secretary of State George Schultz believed everything Elizabeth Homes was saying about Theranos. And Jim Cramer of CNBC was a huge supporter of Bankman-Fried.

Michael Lewis in his book Going Infinite on Bankman-Fried, brilliantly portrays the decidedly brainy and precocious person raised by parents with impeccable elitist left-wing credentials. Both were professors at Stanford. His father taught tax and securities law and mom was a distinguished author on how society treats criminals. She wrote Beyond Blame which argues that everyone is compromised- a blatant tipoff that the parents were not duped, as they now claim, by their son but co-conspirators. After getting into the big money fraud game, she setup a political action fund, Mind the Gap (again, tipping us off to not overlook the gaping expanse of fraud from which the money derived) which gave money 90% to her favorite left-wing Democrat politicians. As way to provide cover to the political con, she threw a few shekels to Republicans.

Read the NPR report details via this link.

It makes one wonder if the investment world is not a simulation. Why? Look at the names of the perpetrators. Bankman-Fried told us that he was freeing investors from the constraints of government issued currency, i.e. freeing us from the “bankman”! Michael Milliken was ostensibly overthrowing cozy capitalism while all the time “milking” his investors. Bernie Madoff, the head of NASDAQ, “made off” with everyone’s money, too while being in charge of securities fraud protection. Elizabeth Holmes promised a new way to extract blood samples as she bled her investors dry-whatever you say Lizzy, not quite Sherlock was she? Even the name of the investment vehicle “crypto” evokes death, which should have alerted the gullible who would eventually be buried.

(The simulation appears in political names too. Arizona has a wanna-be movie star US Senator with the name “cinema“. Our President is “biden” his time until he taps out of the arena. And of course, the man whose name overshadows every play of the cards: Trump! )

The knee-jerk reaction to the latest fraud is predictable-calls for more securities laws and government regulation. Of course, it is lost on those bright bulbs that Bankman-Fried already broke many existing laws. Too, this is the same crowd that wants more gun control laws (people control in reality) when a shooting tragedy occurs. In both cases, the criminals knowingly broke the laws because they alone decided that their choices were superior to the rest of us. Nietzsche made philosophy career out of this nonsensical thinking and is still revered in academia. Perhaps a return to the idea that there are definable rules of right and wrong and that secular materialism as practiced by too many of the elites is not good for anyone.