2024 Economic Models, Schmodels by Dr. Doug Cardell

CONTRIBUTED BY DOUG CARDELL Ph.d. | The Oracle of Oracle

What’s in store for 2024? Before I share what my models indicate, I’ll explain what many economists and virtually none of the media will tell you. ALL MODELS ARE WRONG. That may sound extreme, but it’s easy to see it’s true. A model is a simplification of reality. It is simplified because most realities are too complicated to understand fully. A doll is a model of a person. It’s fine for many purposes, but understanding how the human body functions is not one of them. Too often, people overextend a model’s reach. They open the doll, look inside, and conclude that people are full of cotton. People think a perfect model will lead to perfect results. However, a “perfect” model is no longer a model but an unsimplified copy.

Some models attempt to model chaotic systems, like the weather. You’ve probably heard of the butterfly effect. It describes the possibility that a butterfly flapping its wings in Brazil could precipitate a tornado in Texas. Dr. Lorenz, its discoverer, concluded that no model could ever make useful day-to-day weather forecasts beyond a couple of weeks. This uncertainty is because chaotic systems have vast numbers of independent entities affected by local variables, and tiny changes in even one can have an outsized effect. In the case of the weather, these are air molecules. In the economy, the autonomous entities are producers and consumers.

You might be the butterfly. If you buy an additional gallon of milk next month, that may be the purchase that triggers an increase in the grocer’s next order from their supplier. But since your purchase was an extra gallon you don’t usually buy, it might result in a supply excess at your grocers next month, which could trigger a smaller reorder, resulting in scarcity the following month. The oscillations often increase in magnitude with each repetition and can eventually cause severe distortions in the supply chain, such as toilet paper during COVID-19. Now, neither you nor the butterfly can do this alone, but in either case, you or the butterfly could be the last straw, the final push that tips the system. So, could your buying a gallon of milk in Catalina precipitate a recession in Poland? Yes, that’s the nature of chaos.

Two other factors create economic turmoil: asset bubbles, like the 2007 housing bubble, and rare events, like the recent pandemic. A large part of my doctoral dissertation was a proof that chaos, asset bubbles, and black swans prevented the Federal Reserve from predicting variations in Consumer Price Expenditures within a useful margin of any more than 43% of the time and would never be able to improve reliably.

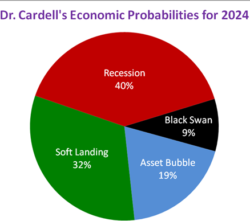

Given those cautions, we can consider the results indicated by my models. They indicate that there is a 9% chance of a black swan upsetting the apple cart and a 19% chance of an asset bubble causing severe economic distortion. The probability of a ‘soft landing’ with no recession is 32%, and a recession’s likelihood is 40%. Of these projections, 59% of the seriously adverse outcomes are attributable to government policy. Depending upon the nature of whatever black swan may appear, the government’s role in creating the crisis is undetermined. Another pandemic might not be the result of government action. Still, a large-scale need for military deployment might be the result of the administration’s foreign policy, while the currently ineffective border policies may result in a substantial terrorist attack.

2024 possibilities?

These projections assume that only one force can drive the economy in 2024, but more than one could combine. The best-case outcome, a soft landing without asset bubbles or black swans, does not get the administration off the hook. The unprecedented reckless borrowing in the past two years caused inflation, and the high-interest rates used to contain mean it may be years before the economy returns to some semblance of normal. Soft landing or recession, we will pay for this folly for years.

Nice article. The “All models Are Wrong” statement is on the money.

One very interesting memo on models and forecasts is by Howard Marks titled “The Illusion of Knowledge” Oaktree. Highly recommended!

This is a great read and reinforces this article. Here is the link:

https://www.oaktreecapital.com/insights/memo/the-illusion-of-knowledge

Few actually believe that forecasts are accurate. The best models require many assumptions. If you start with a false /wrong premise you add to the uncertainty. This article falsely says the Biden expenditures created inflation. We know with 100% certainty that the Trump deficits were several times the Biden levels. The last time the Federal budget was in surplus was under Clinton. Wars and tax cuts changed surplus to deficit. I give little chance that this author has a better mousetrap.

From NBC News “The Obama administration’s stimulus package to respond to the 2008 recession was $787 billion; the pandemic stimulus packages, between the Trump and the Biden administrations, reach around $5 trillion.”

From Stanford “Inflation rises when the Federal Reserve sets too low of an interest rate or when the growth of money supply increases too rapidly – as we are seeing now, says Stanford economist John Taylor.”

and WSJ: Considering all federal regulations, all sectors of the U.S. economy and all firm sizes, federal regulations cost an estimated $12,800 per employee per year in 2022 (in 2023 dollars). Small firms with fewer than 50 employees incur regulatory costs of $14,700 per employee per year – 20% greater than the cost per employee in large firms ($12,200). These estimates are consistent with prior studies, which indicate that the cost of regulatory compliance disproportionately affects small firms.

Since we are talking about numbers, The public debt of the United States of America is $34 trillion and growing. Wrap your head that one.

Mr. Bechky’s interpretation of the deficit and inflation data is incorrect. Here is the raw deficit data from api.fiscaldata.gov. The data is computed over both with and without the COVID years of 2020 and 2021 since it could be argued that the COVID expense was justified.

Year Deficit Inflation

2017 .67T 2.1%

2018 .78T 2.4%

2019 .98T 1.8%

2020 3.13T 1.2%

Trump 4 yr Total 5.56T 7.5%

Trump 4 yr average/year 1.39/yr 1.9%

Trump 3 yr Total w/o COVID 2.43T

Trump 3yr average/year w/o COVID .81T

2021 2.77T 4.7%

2022 1.38T 8.0%

2023 1.7T 3.8 %

Biden 3 yr Total 5.85T 16.5%

Biden 3 yr average /year 1.95T 5.5%

Biden 2 yr Total w/o COVID 3.08T

Biden 2 yr average /year w/o COVID 1.54T

Sorry the table does not line up making it hard to read but this post editor does not allow tabs or extra spaces.

The data clearly shows that in four years Trump’s total deficit was 5.56 trillion and in only 3 years Biden’s total deficit was 5.85 trillion. Biden’s projected 4 year total should be about 7.5 trillion, almost 2 trillion higher than Trump’s. After taking out the COVID years Trumps 3 year total is 2.43 trillion and Biden’s 2 year total is 3.08 trillion. If we add Biden’s project 2024 deficit Biden’s 3 year total should be 4.68 trillion, almost double Trump’s. Biden’s inflation 2.9 times higher than Trump’s. This difference is largely due to the sustained increase in the M1 money supply. In simple terms this is the cash in circulation. It jumped due to COVID relief but should have shrunk down again afterward. It didn’t. The M1 money supply jumped from about 4T to about 16T in mid 2020 due to COVID relief funds. The “Inflation Reduction Act” increased it to 20T in early 2022. It remains at 18T. This is an example of using a crisis (“never let a good crisis go to waste”)to permanently boost a deficit by using deficit spending to pay for things not related to the crisis. Having more than 4 times the money in circulation means that there is a lot more money for the same amount of stuff so each dollar buys less stuff, that is the cause of inflation and there are no facts or extrapolation of facts that let Biden off the hook. He did it.

Mr. Bechky’s claim that “We know with 100% certainty that the Trump deficits were several times the Biden levels” is not supported by the facts. The facts clearly show the opposite. While I don’t see what Clinton has to do with this discussion, it must be pointed out that Clinton’s surplus was achieved by compromising with a Republican Congress. It was a bipartisan effort. Wars and tax cuts have historically had an effect on the deficit but the deficit remained below 500 billion until 2009 in the first Obama administration when it more than tripled to 1.4 trillion. This was with no war, no tax cuts, just increased, unpaid for, government spending. It decreased in Obama’s second term but never got back to the Clinton/Bush era levels. Trump’s pre-COVID deficits never got close to the Obama era peaks. I don’t approach economics from a political perspective. I am a registered independent and I look at the facts rather than either party’s talking points and ideological biases. Please excuse the long post but a complete answer to Mr. Bechky’s comments would require a book. Economics is not as simple as the media would have you believe.