Our Federal Reserve, Often Wrong, Seldom in Doubt

CONTRIBUTED BY DR. DOUG CARDELL, the ORACLE OF ORACLE AZ| November 15th, 2025

The Federal Reserve System was born out of perceived necessity following repeated financial panics in the late 19th and early 20th centuries, most notably the Panic of 1907. During that crisis, the absence of a central authority prompted private financier J.P. Morgan to orchestrate a bailout of the banking system, bringing attention to the fragility of the U.S. financial structure and spurred the call for the establishment of a central bank.

The Federal Reserve Act of 1913 established a decentralized system, comprising a central Board of Governors in Washington and 12 regional Federal Reserve Banks. It was a compromise that attempted to balance federal oversight with regional input, reflecting American skepticism of concentrated authority. It was an effort to assuage those concerned about banking instability due to frequent panics and bank runs, and wishing for elastic currency and a lender of last resort, and to placate the widespread distrust of centralized power.

The Fed’s primary tools are short-term interest rate policy, open market operations, discount window lending, and balance-sheet tools such as quantitative easing and emergency facilities. These tools provide substantial latitude to pursue monetary objectives set by Congress without direct political approval. The Fed’s legal and operational independence enables it to resist politically motivated pressure, such as keeping interest rates artificially low for electoral gain. Political actors can exert influence through appointments, budgets, public pressure, and legislation; however, the Fed’s institutional design and the professional norms of central banking create significant barriers to day-to-day political control.

Since the early 1970s, the United States has operated under fiat money and floating exchange rates. The Fed’s role shifted from defending a gold peg to managing inflation expectations, stabilizing employment, and smoothing financial shocks. Fiat money gives the Fed greater flexibility and introduces greater risk because gold reserves do not constrain monetary policy. Floating exchange rates free it from pegging the dollar but require the Fed to consider international capital flows.

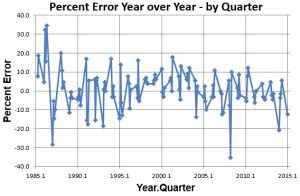

Concerns about the Fed focus on inflationary risk, market distortion, moral hazard, political influence, inequality, and transparency. However, I add to that the larger problem of effectiveness. My published research has analyzed real personal consumption expenditures (RPCE), a measure of aggregate personal consumption expenditures by all individual consumers. I studied 30 years of Federal Reserve staff forecasts for the RCPE and compared the projections with the results. The graph displays the magnitude of the errors as a percentage of the possible range.

The mean percent error over the period was 7.6 percent, the maximum upside error was 34.6 percent, and the maximum downside error was 35.4 percent. In total, there was a 56% chance of a forecasting error greater than 5%, the limit of useful predictions.

Forecasts that are correct 44% of the time are not forecasts; they are guesses.

These errors are not due to incompetence but to the task’s inherent impossibility. The economy is a chaotic environment. Chaotic environments arise when a large number of autonomous or semi-autonomous actors can each influence the behavior of other actors in the system. The weather is an example of such a system. Weather is created by the interactions of air, water, and surface molecules, all of which affect the behavior of other molecules, which in turn affect the behavior of still others, in an infinite set of feedback loops. Economics is also a chaotic system. Economics today comprises a worldwide market of about eight billion people. Each of these eight billion has the potential to influence millions of others, and many do. As a chaotic system, one would expect accurate forecasting to be impossible.

These errors have manifested many times in practice. Milton Friedman showed that the Great Depression of the 1930s occurred primarily because of actions by the Federal Reserve and showed how policy changes could prevent it from happening again. Ben Bernanke, when the Federal Reserve chairman, publicly told Friedman, “Regarding the Great Depression,” he declared, “you’re right. We did it. We’re very sorry. But, thanks to you, we won’t do it again”. However, Bernanke made mistakes that led to the 2007-2009 recession. As a result, many would argue for abolishing the Federal Reserve.

Central banks everywhere are essentially partnerships between politicians and bankers. Politicians profit from spending artificially created money that inflates the economy, and bankers profit from interest payments and commissions. I find it fascinating that two of the groups listed in almost every poll asking “which institutions do you trust least” are the institutions we let manage the money.